Five changes from China’s regulatory reform

January 2020 marked two years since China’s tough new laws on infant formula came into force, and the country continues to ramp up expectations on manufacturers.

Here, we take a look at some of the key changes that have come into force during our decade of sales in China.

1.Safety comes first

Regulation of China’s infant formula industry has been strengthened repeatedly since a 2008 scandal that saw nearly 300,000 babies fall ill and six killed as the result of powdered milk tainted with melamine.

A significant change came with the revised Food Safety Law that meant that, as of 1 January 2018, infant formula products must be registered through a national regulatory body. To secure approval, both domestic and foreign manufacturers must now demonstrate that their facilities comply with the stringent safety standards.

While the majority of applications have proven to be successful, the registration requirement has prevented companies without the necessary capabilities from continuing their operations in China.

The Chinese authorities also announced in August 2019 that they were proposing to tighten up the regulatory process, including stricter registration criteria and heavier penalties for those deemed to have committed offences.

2.Local manufacturers capture the new opportunities

The legislation was introduced in 2018 with the intention of consolidating the market and drastically reducing the number of infant formula brands, as well as promoting local production of infant formula.

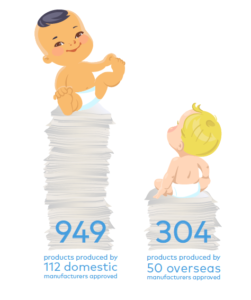

Indeed, statistics from product safety and chemical management consulting firm CIRS show that, up to May last year, 949 products produced by 112 domestic manufacturers were approved. By comparison, 304 products produced by 50 overseas manufacturers were approved in the same time period.

As a result of the current regulatory demands in China, foreign infant formula manufacturers are now facing up to a testing period. In June last year, China announced that it wanted to see domestic producers increase their share of the market to around 60% – an estimated increase of around 20%.

The Chinese authorities have set out plans to improve domestic formula, encouraging manufacturers to collaborate on research for new products and to go above and beyond the existing standards.

3.New GB standards

In late 2018, the newly formed National Health Commission of China (NHC) announced plans to tighten up the country’s ‘GB standards’ (Chinese National standards) for infant formula. There are separate GB standards covering formula for three different age groups up to 36 months, and each mandates minimum and maximum levels of nutrients including fat, protein and various vitamins and minerals.

The GB standards are designed to increase both the safety and efficacy of infant formula products. One impact of their use is that there is less variety between products, which means manufacturers may need to find other ways to set their infant formula apart from the crowd.

4.Quality is key

Regulation of infant formula is very different from other types of food because the formula is the sole source of nourishment for the newborn, and so it needs to provide all the nutrients required for healthy growth and development.

As a result, it is no surprise that quality is one of the most important considerations for parents when buying infant formula.

As a 2018 survey carried out by Advanced Lipids found, Chinese parents care much more about the quality and nutritional value of infant formula than its cost. Nearly three in five (59%) said nutritional value was one of the two factors most important to them when choosing formula, while 45% chose quality and 39% chose safety. Only 6% named price as an important factor.

5.Regulation and opportunity

The new regulations, the consolidation of the market and the rise of local producers have all served to create huge pressure on the market, increasing the need to innovate.

As a result, brands are constantly looking for new, well-substantiated ingredients that can help them stand out in the marketplace. This creates an opportunity in the market for ingredients that have strong scientific backing, which consumers know they can trust.

China remains the world’s most important infant formula market. To stand the best chance of success, it’s clear that manufacturers must seek to deliver top-quality products with top-quality ingredients from trusted suppliers.